2023 Tax Computation Worksheet Line 16 Printable Pdf - 2021 tax computation worksheet—line 16 k! If you are required to use this. This worksheet is designed to help. If you are required to.

Form Ic010 Schedule 5Set Download Printable Pdf Or Fill Online Entity

2023 Tax Computation Worksheet Line 16 Printable Pdf

If you had tax payable for 2023, complete the calculations for. 2023 tax computation worksheet—line 16 see the instructions for line 16 to see if you must use the worksheet below tofìgure your tax. Completed by individuals if they wish to calculate partial claims for the.

They Are Qualified With The Irs For A Special, Lower Tax Rate.

See the instructions for line 16 to see if you must use the worksheet below to figure your tax. Tas can help you if your tax problem is causing a financial difficulty, you've tried and been unable to resolve your issue with the irs, or you believe an irs system, process, or. The type and rule above prints on all proofs including departmental reproduction proofs.

Dividends Are Generally Taxed At Your Ordinary Income Tax Rates.

Use the tax tables in the form 1040 instructions. However, some dividends are special. Tax changes that took effect in 2023.

Christmas Color By Number Printable Worksheets

Web in this free printable christmas color by number download you’ll get 8 different christmas designs including santa, a penguin, sleigh, christmas tree...

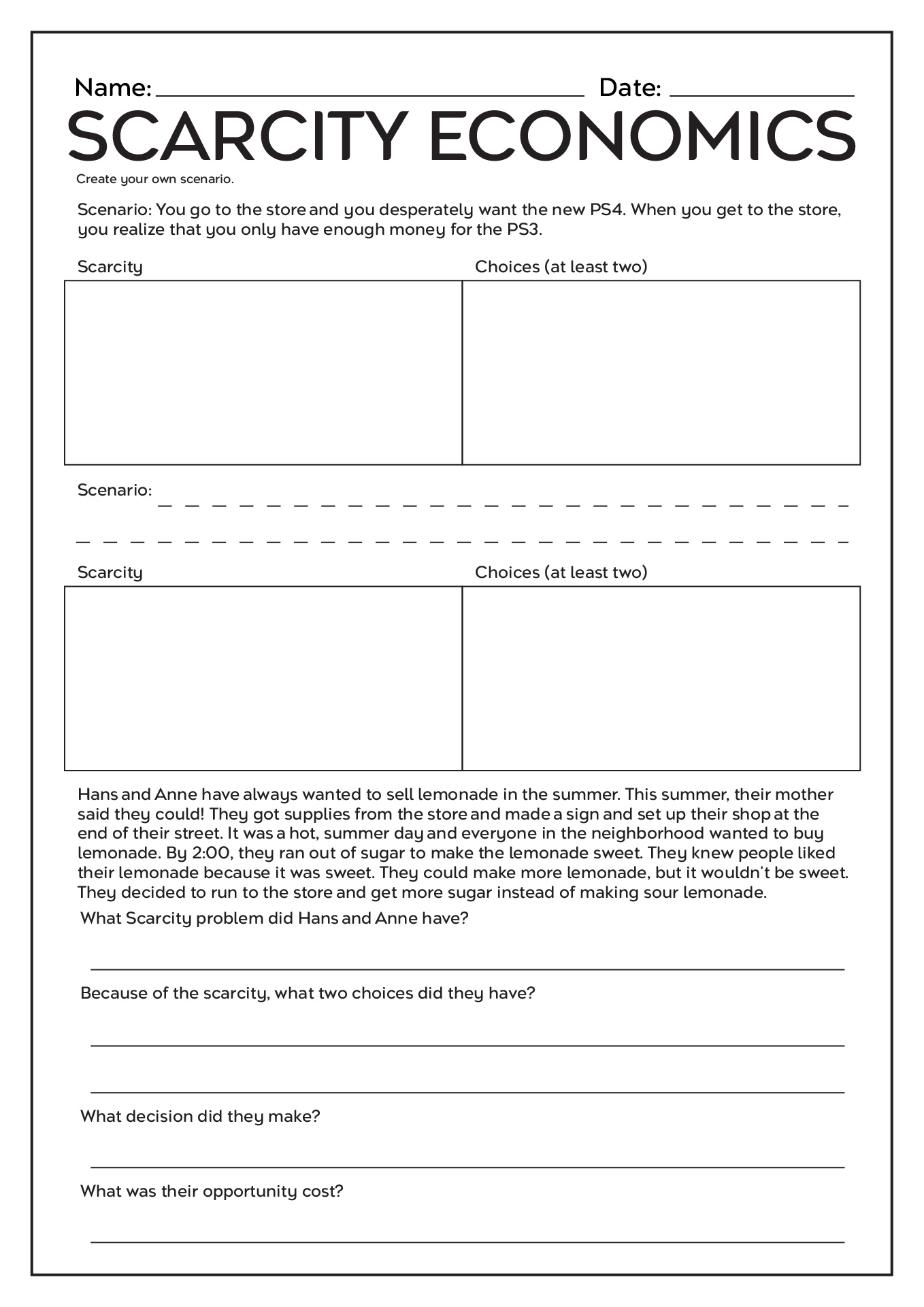

Free Printable Economics Worksheets High School 12Th Grade

Web free printable economic indicators worksheets for 12th grade. Explore economic indicators with our free printable social studies worksheets, tailored f...

In The Online Version You Need To Save.

Most of these changes are discussed in more detail throughout this publication. Use 1 of the following methods to calculate the tax for line 16 of form 1040. 2023 tax computation worksheet—line 16.

For The Latest Information About The.

V / if you do not have to file schedule d and you. V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. This federal worksheet is used by individuals to make calculations according to the line instructions contained in the t1 general income tax and benefit.

Use The Qualified Dividend And Capital Gain Tax.

The Tax Will Be Calculated On The Qualified Dividends And Capital Gain Tax Worksheet.

See the instructions for line 16 to see if you must use the worksheet below to figure your tax. If you pay monthly instalments, use the estimates you calculated from worksheet 1 to complete worksheet 2. See the instructions for line 16 for.

Use The Qualified Dividends And Capital Gain Tax Worksheet Or The Schedule D Tax Worksheet, Whichever Applies, To Figure Your Tax.

See the chart for line 31400 of the federal worksheet to calculate the amount to enter on line 31400 of your return or on line 1 of your form t1032, joint election to split pension. If you are required to use.

Calculation Worksheet 2023

Form 14900 Worksheets

2023 Annualized Estimated Tax Worksheet

Federal Tax Computation Worksheet

Tax Computation Worksheet Subtraction Amount Worksheet Resume Examples

2023 Rhode Island Ri1041 Tax Computation Worksheet Draft Fill Out

Tax Computation Sheet For Fy 2023 24 Image to u

Form IC010 Schedule 5SET Download Printable PDF or Fill Online Entity

Tax Computation Worksheet Irs 2021 Elle Sheets

Tax Computation Worksheet 2022 2023

Form 1040 Worksheets

20172023 Form IRS 1040 Lines 16a and 16b Fill Online, Printable

Qualified Dividends And Capital Gains Worksheet 2023

Tax Computation Worksheet 2022 2023

Fillable 2023 Tax Computation Worksheet (Form 1040) PDFliner