Schedule D Tax Worksheet 2023 Printable - Find out what's new for residents of ontario for 2023 and get help completing your ontario tax and credits form. The turbotax software will include a schedule d tax worksheet if required based on the investment sale to calculate taxes on the taxable income. It does not get filed with your return. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d.

Schedule D Tax Worksheet 2020

Schedule D Tax Worksheet 2023 Printable

Use these charts to do calculations you may need. The sale or exchange of a capital asset not reported on another form or schedule. Here’s how to fill it out and what you’ll need to send to the irs.

Use This Worksheet To Figure The Estate’s Or Trust’s Tax If Line 14A, Column (2), Or Line 15, Column (2), Of Schedule D Or Form 1041, Line 22 Is Zero Or Less;

We last updated the capital gains and losses in january 2024, so this is the latest version of 1040 (schedule d), fully updated for tax year 2023. This form can be signed electronically. The tax will be calculated on the qualified dividends and capital gain tax worksheet.

These Instructions Explain How To Complete Schedule D (Form 1040).

However, some dividends are special. Also, remember to print the capital loss carryover worksheet for the taxpayer to keep as part of their records. Use schedule d (form 1040) to report the following:

Christmas Color By Number Printable Worksheets

The activities foster number recognition,. These color by number sheets are an easy activity with no prep. Color by number coloring pages. Get ready to mak...

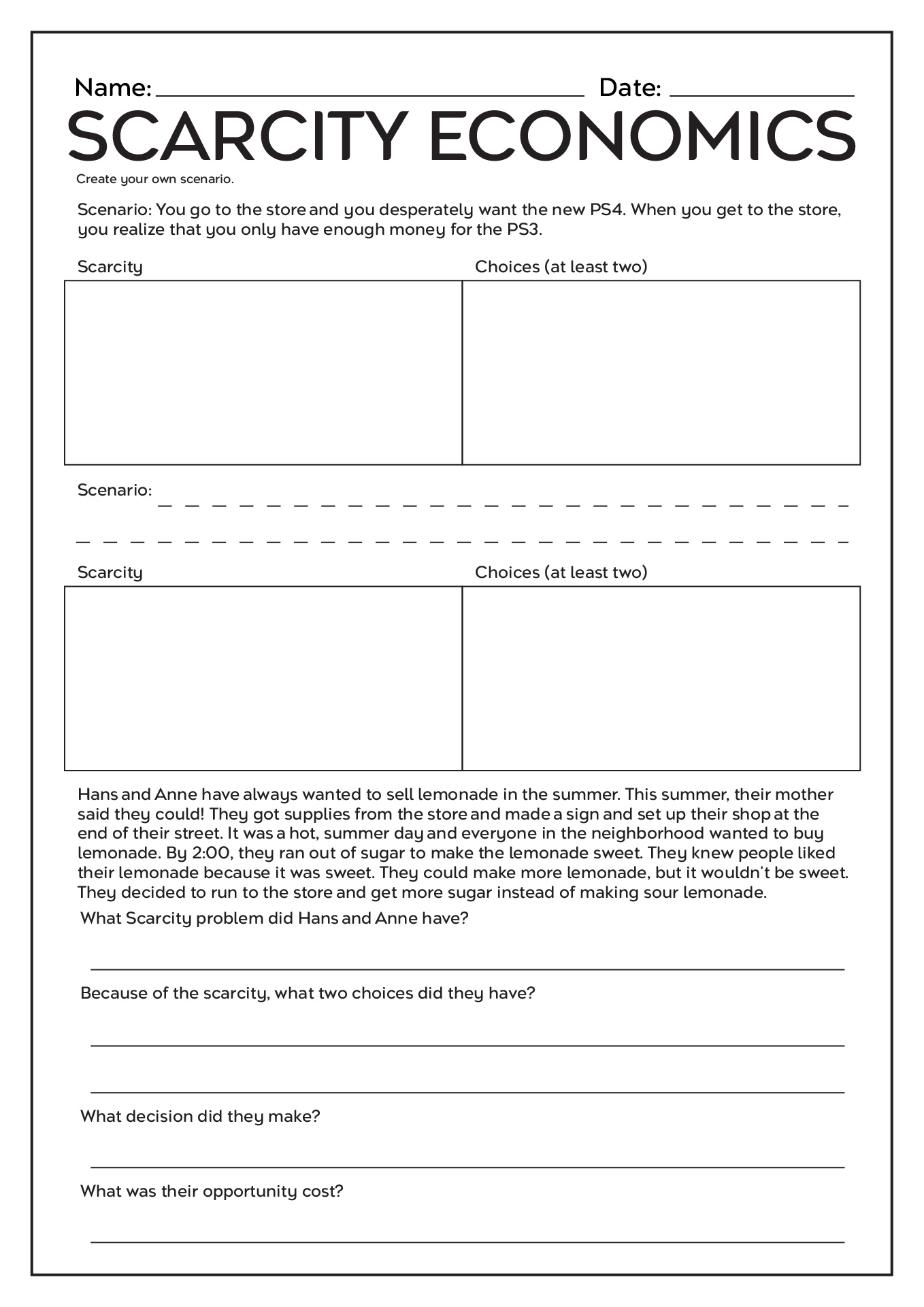

Free Printable Economics Worksheets High School 12Th Grade

Web browse 12th grade economics worksheets on teachers pay teachers, a marketplace trusted by millions of teachers for original educational resources. Web ...

This Federal Worksheet Is Used By Individuals To Make Calculations According To The Line Instructions Contained In The T1 General Income Tax And Benefit Guide.

To view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable gain of the entries. These instructions explain how to complete schedule d (form 1040). Capital gains and losses.

Use Form 8949 To List Your Transactions For Lines 1B, 2, 3, 8B, 9, And 10.

The schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. You can download or print current. In the online version you need to save your return as.

The Documents Listed On This Page Contain Instructions For Filing Your Income Tax Return For The 2023 Taxation Year.

Schedule d of form 1040 is used to report capital gains and losses on your taxes. They are qualified with the irs for a special, lower tax rate. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d.

Dividends Are Generally Taxed At Your Ordinary Income Tax Rates.

Calculate some of the amounts to. It will also include a qualified.

1040 Capital Gains Tax Worksheet 2022

Schedule D Tax Worksheet walkthrough YouTube

1040 Schedule D Worksheet

2023 Form 1040 Instructions Printable Forms Free Online

Schedule D Tax Worksheet 2020

Qualified Dividends And Capital Gains Worksheet 2023

What Is Schedule D Tax Worksheet Studying Worksheets

Schedule D Tax Worksheet 2022 Irs

Schedule D Form 1040 Tax Worksheet 2023

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)

Irs Form 1041 For 2023 Printable Forms Free Online

2023 schedule d instructions Fill online, Printable, Fillable Blank

Schedule d 1065 20222023 Fill online, Printable, Fillable Blank

/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)

Schedule D Tax Worksheet Excel

Schedule D Tax Worksheet 2020

2023 Estimated Tax Worksheet Excel