Tax Computation Worksheet 2022 Printable - How can you get into a lower tax bracket? What is a marginal tax rate? Most of these changes are discussed in more detail throughout this publication.

Ri Tax Computation Worksheet 2021

Tax Computation Worksheet 2022 Printable

If you are required to use this. 2022 federal income tax brackets and rates. Personal finance & taxesbudget guides & advicefinance calculatorsmoney & retirement

2022 Tax Rate Schedule.

How do tax brackets work? If the amount on line 5 is $100,000 or more, use the tax computation worksheet Use the advanced salary calculations to tweak your specific personal exemption and.

What Are The Tax Brackets For 2022 (For Filing In 2023)?

See the instructions for line 16 to see if you must use the worksheet below to figure your tax. *for taxable years beginning in 2022, the standard deduction. If the amount on line 5 is less than $100,000, use the tax table to figure the tax.

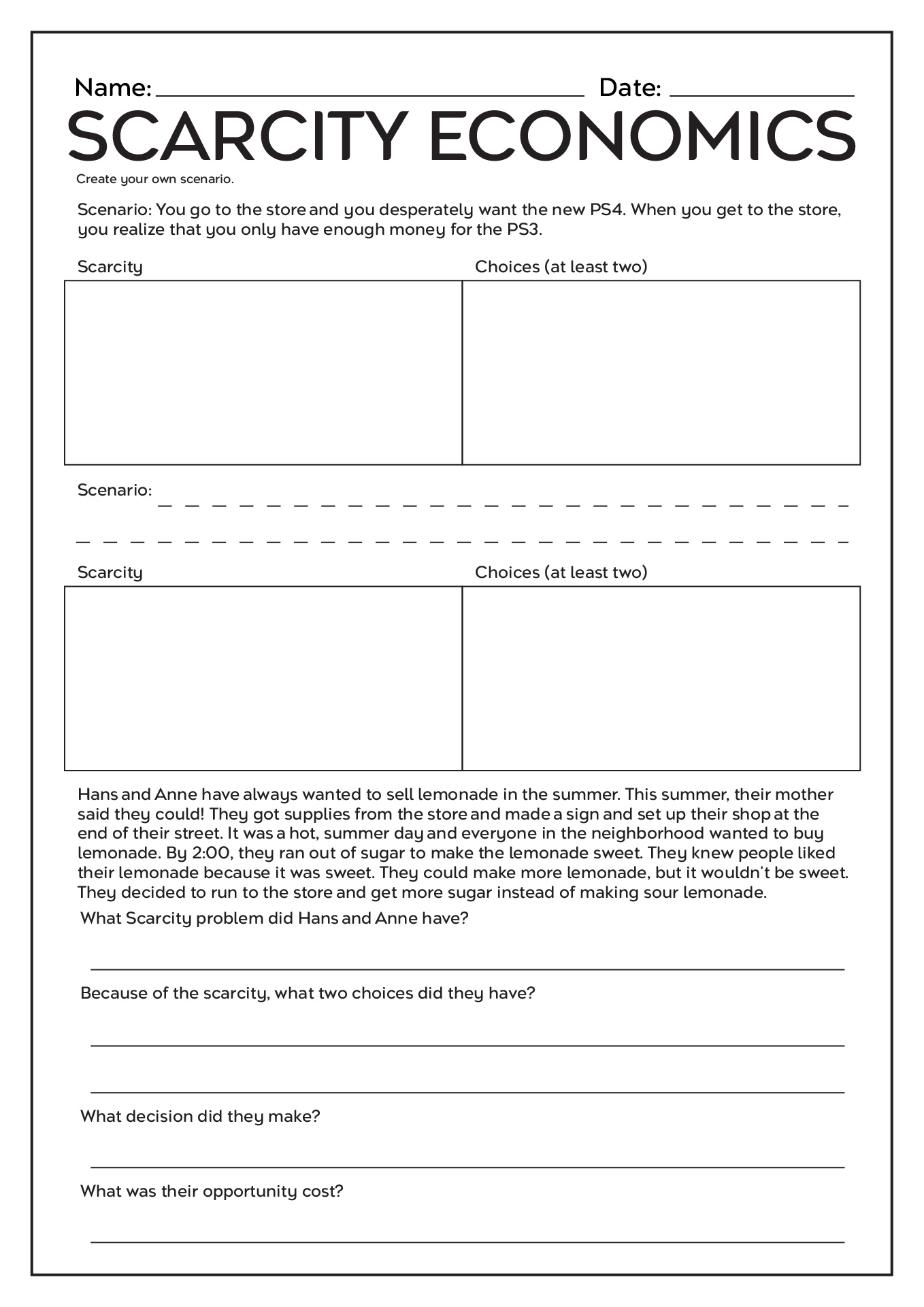

Free Printable Economics Worksheets High School 12Th Grade

Includes worksheets about goods and services, supply and demand, and. Explore economic indicators with our free printable social studies worksheets, tailor...

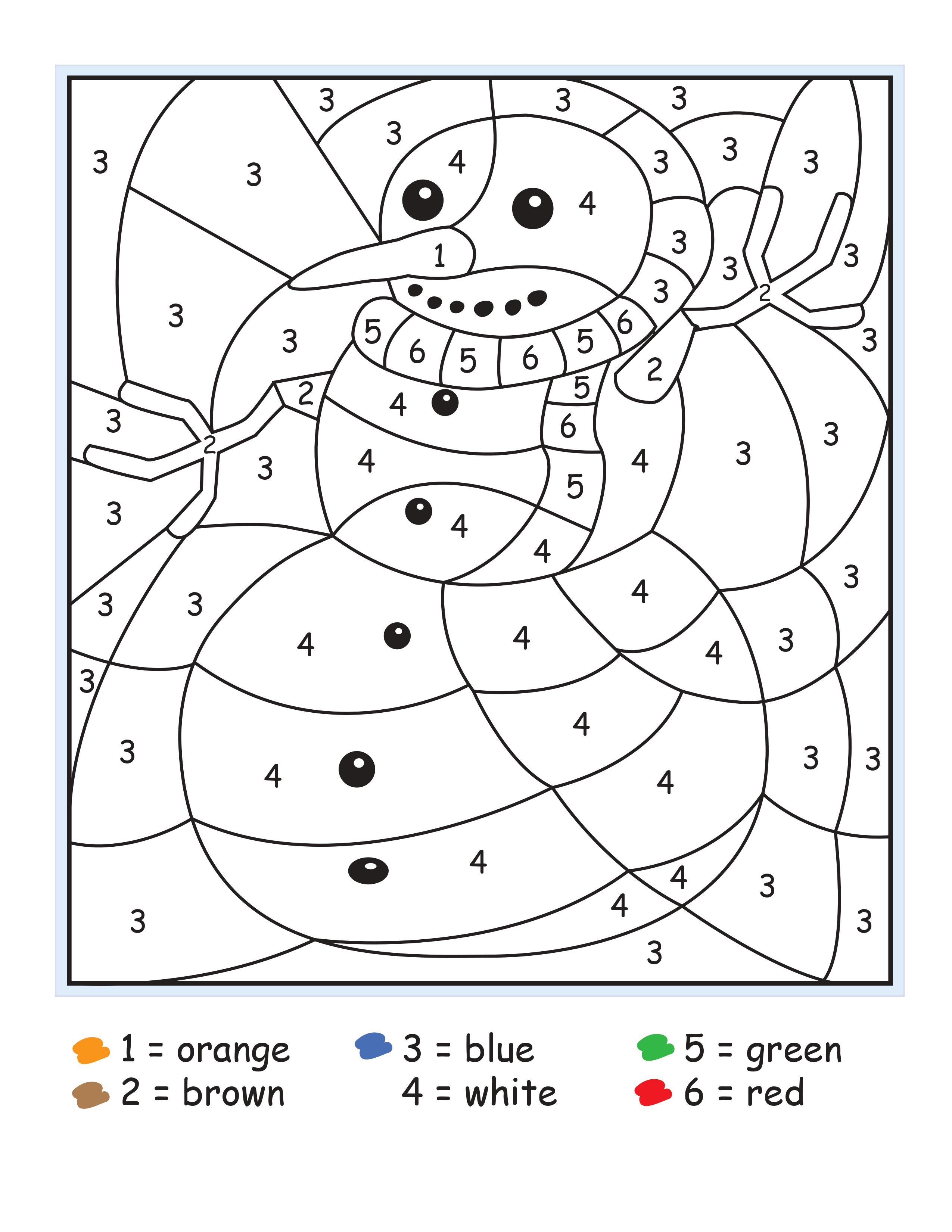

Christmas Color By Number Printable Worksheets

Get ready to make some merry memories with our christmas color by number printables,. Web free printable christmas color by number pages. Web christmas co...

The Type And Rule Above Prints On All Proofs Including Departmental Reproduction.

Standard deductions & personal exemption. Page 4 of 26. The form 1040 tax computation worksheet is an essential tool furnished by the internal revenue service (irs) that allows taxpayers to detail their income and adjust it with.

A Comprehensive Federal, State & International Tax Resource That You Can Trust To Provide You With Answers To Your Most Important Tax Questions.

For the latest information about the. The return may have an alternative minimum tax rate, there may be foreign income involved, or the return may have qualified dividends and/or capital gains which may be. In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Note That Most States Do.

Simply enter your annual earning and click calculate to see a full salary and tax illustration. Print the amount from line 3. You may also need the three.

If Line A Is Greater Than $12,500 ($25,000 If Filing Status Is 2 Or 5), Print $12,500.

2022 tax computation worksheet—line 16. Tax changes that took effect in 2023.

Ri Tax Computation Worksheet 2021

Irs Tax Computation Worksheet Worksheets Ratchasima P vrogue.co

Tax Computation Worksheet 2017 In Excel Sales Problems Pictures Real Estate Investment

Sample Tax Computation EX Tonga, Chriszel Mae S. EXERCISE ON COMPUTING INDIVIDUAL TAX

Tax Worksheets 2022

Dividends And Capital Gain Tax Worksheet

Line 5 Worksheet Schedule 8812

2022 Tax Rate Calculation Worksheet Lake Worth, Texas

Form 14900 Worksheets

2022 Tax Rate Calculation Worksheet Lake Worth, Texas

Irs Tax Computation Worksheet 2020

Tax Preparation Worksheet 2022

2019 Tax Computation Worksheet Calculator

Tax Computation Worksheet 2022 2023

19+ Calculation Worksheet 2022 GarionTinaye